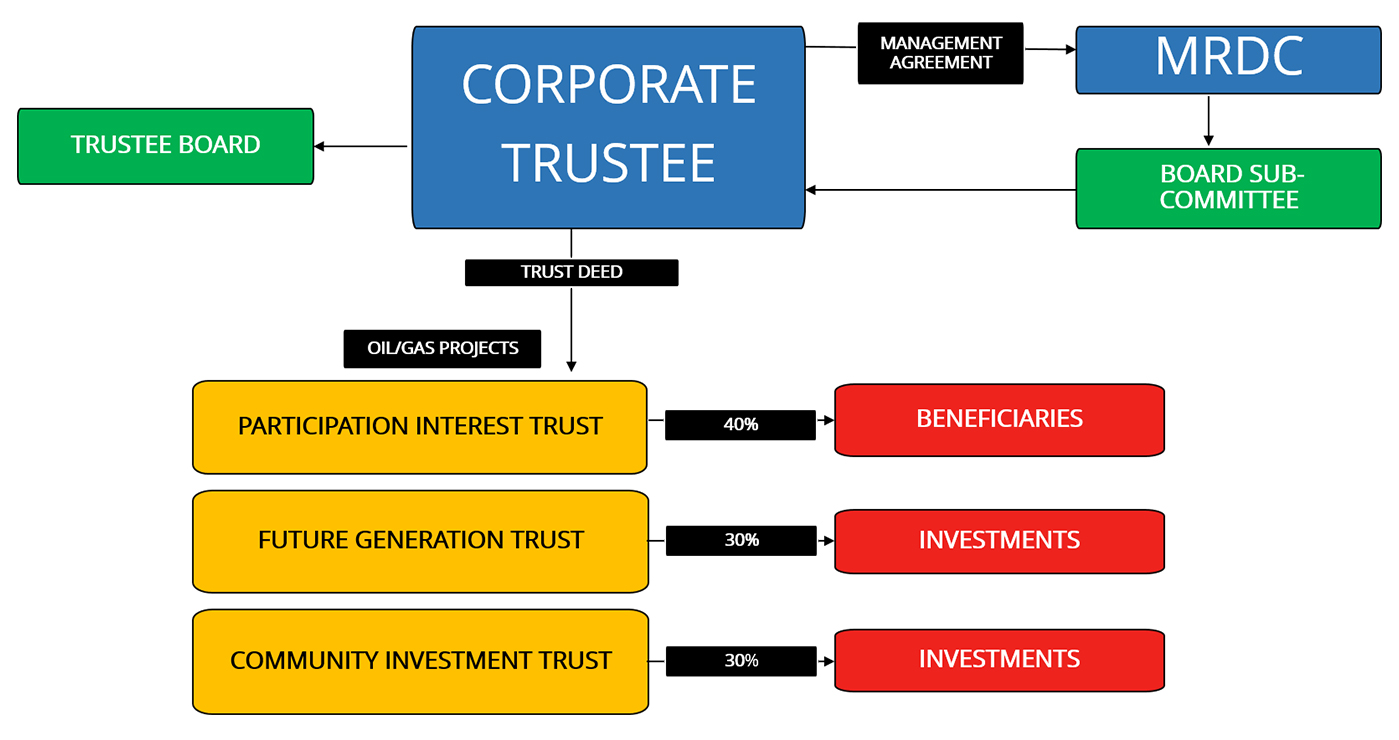

The Trust Deeds have very specific guidelines for the management of the funds. The guidelines provide for the investment, management and accounting of the equity and royalty funds. The Trust Deeds allow the trustee to distribute a percentage of the trust funds to the beneficiaries. Furthermore, the guidelines in the Trust Deeds ensure that the landowner moneys in the trusts are invested in business ventures and projects that can generate acceptable returns which will increase the value of the Trusts.

One of the Trusts also allows for investment in certain infrastructure to improve the quality of life for the people in the project area whilst at the same time undertaking long term investments to create revenue sources for the next generation who may not have the current projects operating to create benefits.